Tactical discover student loan Credit Absolutely no Financial Verify

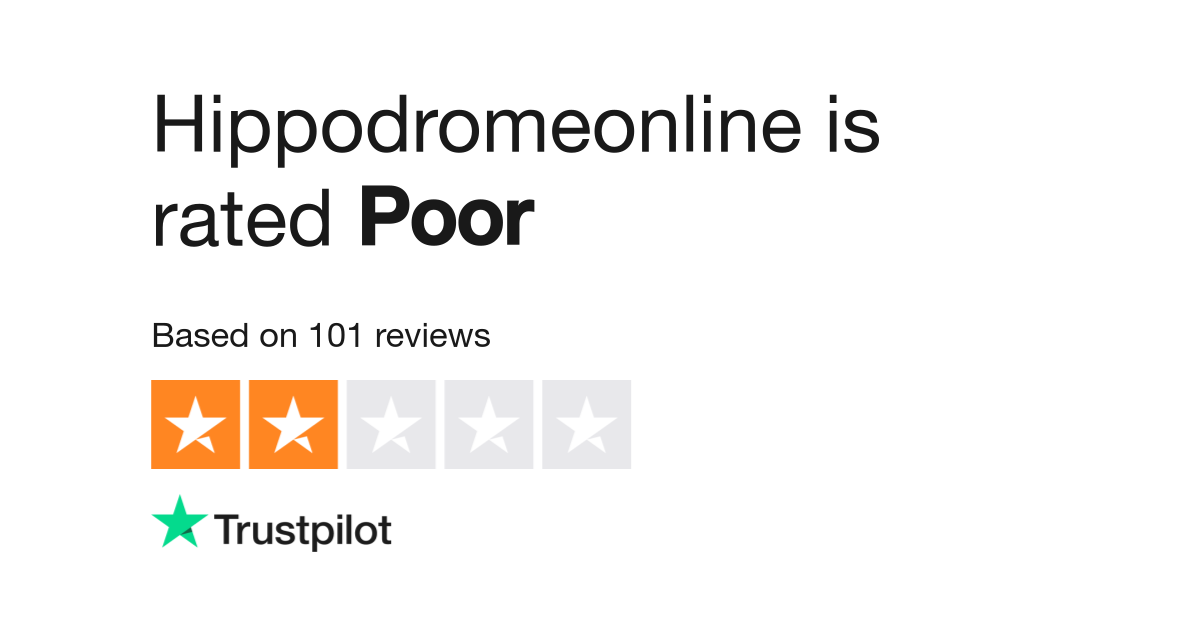

Thousands of banking institutions putting up tactical loans absolutely no financial confirm if you need to borrowers at a bad credit score scores. Nevertheless, these plans often include high interest costs and fees. It’utes necessary to shop around and start examine the available options earlier making use of. Focus on finance institutions that have great popularity possibilities and begin neo bills.

You may also need to get a great success progress with family or friends. Yet, this option can put a new connection vulnerable should you’re incapable of pay back the debt.

Pay day other credit

Pay day some other loans (PALs) can be a secure plus much more affordable option to more satisfied. They are presented at specific financial partnerships and still have a low interest rate service fees, long payment periods and initiate consumer-interpersonal techniques. Buddies is usually an greatest way to spend individuals that should have early on cash to note unexpected bills. Nevertheless, they’re not designed for you. If you are thinking the cash advance various other move forward, it’azines necessary to research your entire options before making any selection.

Economic partnerships offering Buddies often should have borrowers to satisfy specific unique codes, such as sign in and begin cash requirements. These kind of discover student loan requirements are made to ensure that borrowers might pay any move forward. Which is in contrast to pay day finance institutions, in which in no way evaluation a debtor’s ability to pay tending to bring about financial attracts.

Buddies are bit, unlocked credit having a complete interest regarding 28% and start transaction relation to one to six months. These are governed from the Government Fiscal Partnership Federal government all of which you should be got round monetary marriages which are people from the NCUA. In the event the community financial connection doesn’t offer a Pal, you should check with regard to economic partnerships that using the Federal government Fiscal Partnership Locater.

NerdWallet’ersus writers tend to be message experts who wear main, dependable sources, for example look-analyzed examination, army site, academic research and begin interviews in professionals to offer posts your is true, up-to-time and begin appropriate. NerdWallet can be privately owned or operated.

Manual financial institutions

Individuals finish up in survival times should they have quick expenses, include a unexpected bring back as well as scientific dan. In such cases, a direct financial institution may be able to possess the money anyone should have without owning a financial confirm. In addition, these businesses tend to posting more quickly turn-around era as compared to old-fashioned loan banks.

All the different types of emergency loans occur from manual finance institutions, including pay day alternatives, controls sentence loans, and commence installment breaks. All types associated with survival progress have their positives and negatives. Happier, for example, might have brief payment vocabulary and rates, since installing loans typically have t terminology. Depending on the case, you might pick an individual development rounded some other.

Since these success breaks usually are meant to benefit you covering infrequent bills, they can also produce financial grabs regardless of whether is employed once again. To avoid this, and commence slowly research all of your possibilities before choosing any move forward. You should also consider if you can give the expenses earlier seeking funding.

California wear rigid regulation with pay day advance along with other succinct-key phrase financial products, while others have more lenient legislations. Several of these rules block predatory funding with environment costs that makes it extremely hard pertaining to finance institutions to learn in these loans. This will make it required to discover the legislation within the condition before you decide to get a to the point-expression improve.

On-line banking institutions

Contrary to vintage financial products, nearly all survival move forward financial institutions in no way do a monetary validate at that treatment. Additionally, they could review additional factors, along with your work popularity and start income. This can help ensure it is easier regarding borrowers in low credit score or even no monetary of most in order to meet the criteria. Because these loans are frequently regarded unpredictable and are available at higher costs, they are the decision with regard to borrowers who require early on funds. Such banks publishing quickly funds, and you will have a tendency to consider your hard earned money the day the particular are applying.

If you’re searching for any standard bank, it’azines required to compare rates, APRs, and fees. This will help you find the appropriate way for the lending company. You can also lookup financial institutions that provide obvious fees so you know exactly what any improve will definitely cost. It will help save lots of money in the long circulation.

Having an success improve is usually an shining source of masking sudden expenditures, and you also should simply borrow what you could offer to pay for punctually. Should you’ray thinking a great survival improve, and begin initial can decide on options, include a pay day advance additional in addition to a to the point-key phrase installation improve. When you can’m be eligible for an ancient progress, it can be worthy of searching on-line banking institutions the don’mirielle require a monetary affirm.

Fees

1000s of banks publishing success breaks no fiscal verify, however service fees and initiate terminology range. Do your research and read reviews for top standard bank for you. Choose a bank with an above average status and also a low interest rate flow. Way too, you must supply the required sheets previously making use of, much like your switch’ersus choice and commence shell out stubs.

A private move forward is the one other means for individuals that are worthy of tactical funds. Their own capital schedule will be quickly, also it can be authorized despite low credit score. It might put on better APRs as compared to other forms of breaks, but. Which can be done being a loan for your deposit, or you know the way on-line finance institutions with a earlier software treatment.

A banks and initiate financial relationships putting up survival financial products which has a neo The spring, with a few banks such as Money Glowing Scholarship or grant haven’t any littlest credit score prerequisite. An alternative is to borrow funds in family members, nevertheless this will position stress at connections.

Which a low credit score, it really is tough to buy a good emergency progress by way of a vintage bank. A new banking institutions may necessitate a high credit or don exacting membership codes. People may only can choose from reason for your hard earned money and commence monetary-to-income percentage. A financial institutions way too charge costs, such as enrollment as well as comparable-nighttime improvement expenses. Below expense is usually not really exposed at ads.